|

I’m sure you’ve been there, that shopping trip where you browse the entire store, finding things you’ve just “gotta have” and once you get to the checkout, you’re faced with the realization that not only did you buy what you didn’t need, but you didn’t get anything you actually needed.

Your cart filled up with pretty stuff, you blew the budget, and you don’t even know how it happened. Meanwhile, you lost hours of precious time and didn’t really get anything done. This is the same aimless frustration you might experience when you first start looking into real estate syndication deals. It’s possible you’ll begin to receive a seemingly endless string of opportunity emails, each with a summary that could be 50 pages long! Although this is exciting, without knowing specific tactics, your goals, and a strategy for sifting through these, that aimlessness might turn into overwhelm. Ain’t nobody got time for that! Right here, right now, you’re going to learn how to put a stop to that meandering and decide within 5 minutes if a deal is right for you. Financial Freedom vs. Financial Independence: How They’re Different, And How You Can Get There10/16/2020

The two terms, financial independence and financial freedom are used interchangeably, but what does financial independence really mean, and how’s it different from financial freedom?

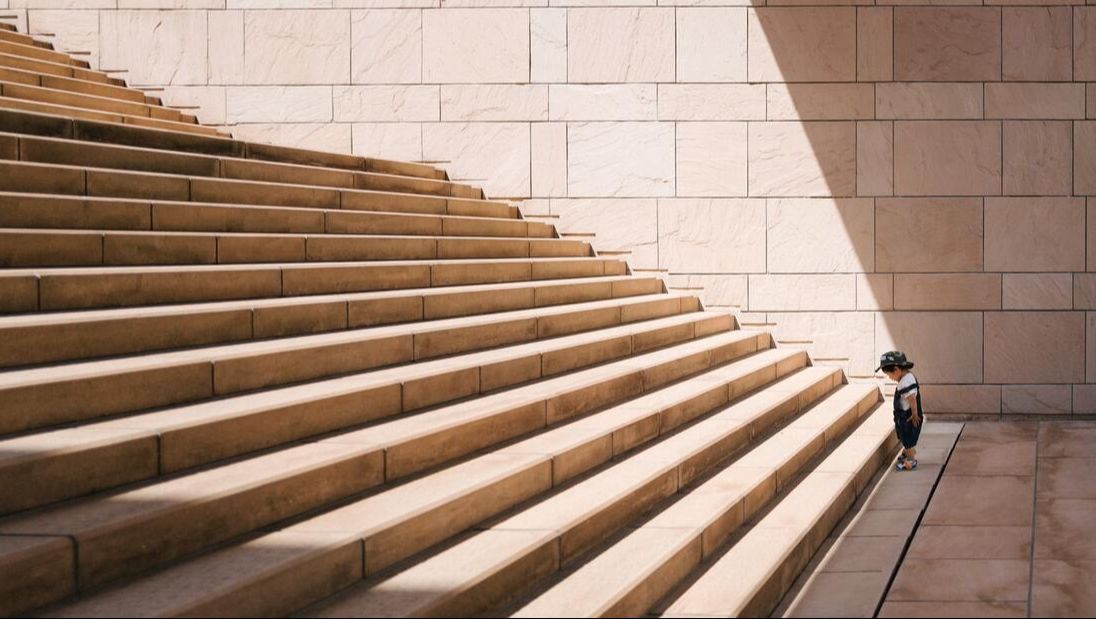

Consider a toddler learning to walk. Once they figure out how to pull up and take a few steps on their own, they have achieved a new mobility level. They may not need their parents to carry them from room to room as often. However, you wouldn’t expect that same toddler to walk the entire Zoo visit or walk all the way to the park the following day. They haven’t achieved full FREEDOM yet, although that subject will be revisited around the age of 18. Money works the same way. Let’s dissect what it means to be financially independent vs. financially free and how investing in real estate can help get you there. The Beginner’s Guide to Investing In Real Estate: Choosing Investments For Your Investor-Type10/9/2020

There are TONS of ways in which to get started investing in real estate. Everything from crowdfunding sites to residential real estate fix and flips to commercial storage units and office buildings are at your fingertips if you know where to look.

This is also why, as a beginner in the whole wide world of real estate investing, you might feel overwhelmed. However, with a little guidance, you’ll be able to narrow down which types of investments suit your lifestyle, financial goals, and personality best. In our last article, we walked together through gaining a macro-view of your current life situation, determining your why, deciding how hands-on you desire to be, assessing your risk tolerance, and even learning how much money you’re ready to invest. Ultimately, it’s likely that, after slogging through those six soul-searching steps, you fall into one of these groups:

Ready to learn which investments fit each type of investor? Let’s go! I often get asked, “What’s the best way to get started investing in real estate?” Let me reassure you, there are many ways to get started and that you aren’t alone if you’ve been interested and haven’t quite made the jump yet.

This article will help relieve some of the overwhelming and intimidating subjects investors face in leaping into the space by helping you self-diagnose your status, deciphering what you want, and revealing the best way to get started with those two factors in mind. What we’ll cover:

|

Justin GrimesAlly in generational wealth creation & protection. Archives

October 2020

Categories |

RSS Feed

RSS Feed