The Beginning

|

Perhaps like many others, my reason for investing in real estate and businesses was and remains very personal to me. As I began, not only was I in pursuit of greater stability and fulfillment in my life. I was also in need of a tool to protect assets left to my family.

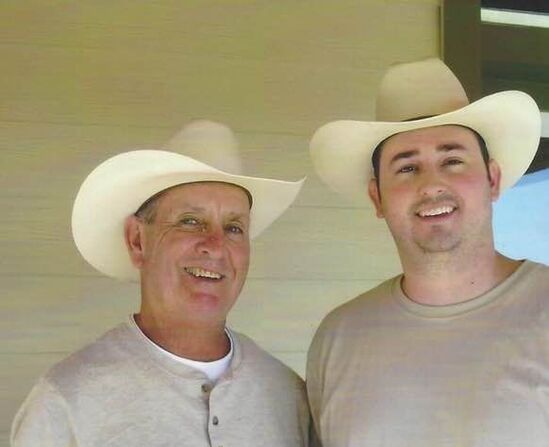

On May 23, 2016, while on his way home from work (on a day that he didn’t need to go in), my father, James Michael (“Mike”) Grimes, was killed in an 18-wheeler rear-impact auto accident. He had just turned 65 years old four weeks earlier. My wife was 6 months pregnant with our first son (his first grandchild). I remember getting the call that day while I was unloading my sons crib to put in his new nursery. I came inside and had two missed calls from an uncle and one from my brother. Not thinking much of it, I returned my brother's call and received the news. A blur of life began and continued off and on for some months. Many events around the time of the accident are a mix of dream and nightmare like circumstances. As a facility director at a retreat center, my father was able to bring on one helper (Sean) for some of the more labor-intensive activities. The day of the accident, he did not pick up Sean. I vividly remember a moment the day after the accident, when Sean showed up as I was driving around my parent's property. I had never met Sean. As I shared what had happened, he dropped to his knees and cried. He said “I was supposed to be in that truck with your dad.” We shared that moment in tears. My dad had gotten him the job just a few weeks prior by asking around town for a good guy that needed work. For whatever reason, that day, there was very little work to do so my dad didn’t pick up Sean. As we visited a bit, I learned Sean and his wife were expecting a baby in a few months (like my wife and I). In that moment, I shared with him that he was never meant to be in that truck. God had other plans for him and Mike was in place to make sure he wasn’t there that day. That period of life was amazingly difficult, as many can understand or at least imagine. It seems impossible to adequately put into words. The most extreme joyous feelings of my wife about to give birth to our first son and the emptiest sorrow of losing a father and great friend. To be crying tears of misery one week and tears of joy the next – it was a real roller-coaster. |

|

The Middle

|

As things settled down over the following weeks, I began to wonder what we were going to do. My mom was a retired school teacher living on 56 acres of land that they had purchased 25 years prior with the dream of one day being able to live their later years of life out there – watching grandkids play and cattle graze. They had just purchased 3 longhorns each with calf. My dad had spent countless hours and put vast amounts of love into his little piece of heaven – The 56 Ranch (pictured throughout this page). He had reworked pastures and fencing, shaped and stocked ponds and built a house. He had really created a jewel of property for our family to enjoy. As death has a way of working - in the blink of an eye, everything had been flipped on its ass. His body was gone from this earth. But I was determined to make sure his legacy and spirit lived on in the many gifts he left behind for us.

After nine months of processing our emotions, we discussed what we felt my dad would want for us to do moving forward. He was a guy full of love for others with a knack for finding positive outcomes from shitty situations. For example: he grew up in east Texas, where from what he told my brother and me in a joking manner – duct tape was the preferred cure-all for everything from faucet leaks to broken bones. He could find something positive in any situation. He had his faults like the rest of us. But Mike, as he asked we call him when we got older, was one of those guys who would (no shit) give you the shirt of his back if you needed it. We decided that his first obligation would be to take care of the love of his life, Pam, and make sure she was able to continue to live a life of joy and peace. So, we put a plan in place that would allow for that goal to be met to the best of our ability, given the circumstances. Over time, our plan was to peel off pieces of investments held in stocks and bonds and put them into something I felt we had more control over. Thus, my passion for real estate kicked into high gear. I needed an education first, though. I had never considered the ins and outs of wealth creation or protection much less financial independence. So, I began to read as many books and listen to as many podcasts as I could. I attended seminars and meetups. It wasn't long before I was hooked. I was mesmerized by the variety of opportunities you could explore in real estate. Prior to his passing, we had discussed investing into single family rentals. As time went, the thought of putting all our chips into one basket (or door in this case) seemed like a poor idea. I had a few years of experience with rental property that made a little money here and there. However, the entire profit was consistently wiped out when a repair or new appliance was needed. What I needed was something that could offer fairly passive and predictable returns with stable protection from market volatility. While all investments have risk, I am a believer that through diversification, in many senses of the word, you can shield yourself from a fair amount unfavorable exposure. |

The Future

|

With an overall vision of where I wanted to go, we set up a string of entities aimed at protecting our family while actively growing wealth and pursuing a more fulfilling life. In 2017, we established a family holding company named M56 Capital (in memory of my father Mike and his 56 Ranch) whose main purpose is to generate and protect multi-generational wealth. Our stated mission is to deploy capital in non-institutional cash flowing equity opportunities that are actively managed by experienced operators with low-risk collateralized short-term investments. Through this focused effort, I have met some amazingly talented teams in the multi-family, self-storage and mobile home park spaces who align well with our family’s values and goals. As I tell people when we co-invest, "I am betting with my mom's money so you can count on me truly believing in the deal and the operating team because I can't afford to mess this up."

Simultaneously, my wife and I began Timbermoss Capital with the intent to piggy back off of the time and effort I was putting into this real estate endeavor. Through strategic partnerships, we have been able to establish the foundation for multiple streams of income so as to never be dependent on one single source of income. Stability through strategic diversification is the motto. My vision is to achieve an abundant life of fulfillment where we add value to our family while giving to others on a daily basis. Our first son was born three months after Mike's passing in 2016. Our second son was born two years later, on May 23, 2018 - the EXACT day at what I believe to be near the same time that Mike passed away. I am not a very religious person, but if that isn't a gift from God to remember my dad and my son on the same day, I don't know what is. Today, years after the most tragic event in my life, I feel very blessed to find myself in a position to call some of the people I have met friends, business partners and mentors who I look up to and model to the best of my abilities in various tasks I undertake. My journey has been full of ups and downs - but I am focused on the future and making the most of each situation I encounter. |

I believe Mike would be proud of where I am and where his family is headed - together.

If you made it this far, you may have just read that whole page. And for that, I am appreciative and I sincerely thank you.